A leak that could reshape the investment landscape: how a former AWS engineer exposed the inner workings of a new AI-based investment assistant now quietly being trialled in Europe

In early June, Reddit was shaken by an unexpected post: a former Amazon Web Services engineer shared screenshots, code snippets, and internal documents relating to a project that had never previously been made public. The project, known as AI Wealth Grid, is a new investment platform developed in partnership between AWS and BlackRock, and is reportedly already being tested by a limited number of users in Germany and the UK.

The information surfaced abruptly and triggered widespread speculation: why hadn’t such a product been formally announced, given the involvement of two major industry players? And more crucially — why, while most people are losing money in a slumping crypto market or leaving savings idle in accounts yielding zero interest, has someone already been granted access to a tool that automates investment quietly and efficiently?

Where did the leak come from?

According to a post published in the r/EuropeTech subreddit, a former AWS DevOps engineer using the handle @LogicGatekeeper66775 claims he discovered the project during an internal security audit. He writes:

These screenshots quickly spread across Telegram channels and other social networks, sparking heated debates in the comments: isn’t this a little too much like a “closed solution” accessible only to the elite?

Some users put forward the theory that the platform may have been intentionally kept under wraps for political reasons — after all, autonomous access to real capital growth, without the involvement of banks or brokers, poses a threat to traditional financial structures.

What is behind AI Wealth Grid — and why is it needed?

AI Wealth Grid is an intelligent investment system built on Amazon Web Services infrastructure and the Aladdin algorithmic framework developed by BlackRock, one of the world’s largest asset management firms. Until recently, access to such tools was reserved for banks, funds, and institutional investors — in other words, the financial elite.

No official announcements have been made by Amazon or BlackRock regarding private onboarding, but the Reddit leak confirmed that the system is already in active testing across the UK and Germany. Interestingly, the project isn’t closed — quite the opposite. It has been designed to be self-learning, with an interface tailored for everyday users, even those without any financial background.

The BBC editorial team reviewed technical documentation and early user feedback. According to publicly available information, AI Wealth Grid autonomously analyses market conditions, economic signals, current events and financial news, and reallocates each user’s portfolio on a weekly basis — depending on the selected objective: “stable income”, “balanced growth”, or “aggressive tech breakthrough”.

But why now?

The answer lies in ongoing market turbulence. With the collapse of major crypto assets and diminishing returns from traditional investments, millions of private investors across Europe are looking for reliable alternatives. Automation, transparency and institutional-level protection have become the new norm — and by all indications, this is exactly what the creators of AI Wealth Grid are counting on.

Testing geography: why Germany and the United Kingdom?

According to the leaked information, AI Wealth Grid is currently undergoing closed testing in two key jurisdictions: Germany and the United Kingdom. These markets were not chosen at random — both are recognised for their advanced digitalisation of financial services, well-established open banking infrastructure, and strong appetite for fintech innovation. As one former AWS systems architect explained in an interview:

According to details from the leaked screenshots, the system is already serving more than 8,000 active investors across the two countries. Most accounts appear to be linked to local banks, including Commerzbank, Deutsche Bank, HSBC, and Revolut.

One of our editors decided to test AI Wealth Grid first-hand and kept a detailed journal — here’s how it went:

DAY 1I wasn’t entirely sure what I was getting into. The names mentioned on Reddit were just too big — Amazon, BlackRock, an AI investment platform... I had to see it for myself.

I created an account and deposited £250 using my debit card. The interface was surprisingly straightforward. I selected the Balanced Growth strategy and left the deposit untouched — as advertised, the algorithm handles everything automatically.

Fifteen minutes later, I received a notification: the first trade had closed in profit — +£11. An hour after that, my balance was already showing +£38. I wasn’t doing anything — just watching it happen.

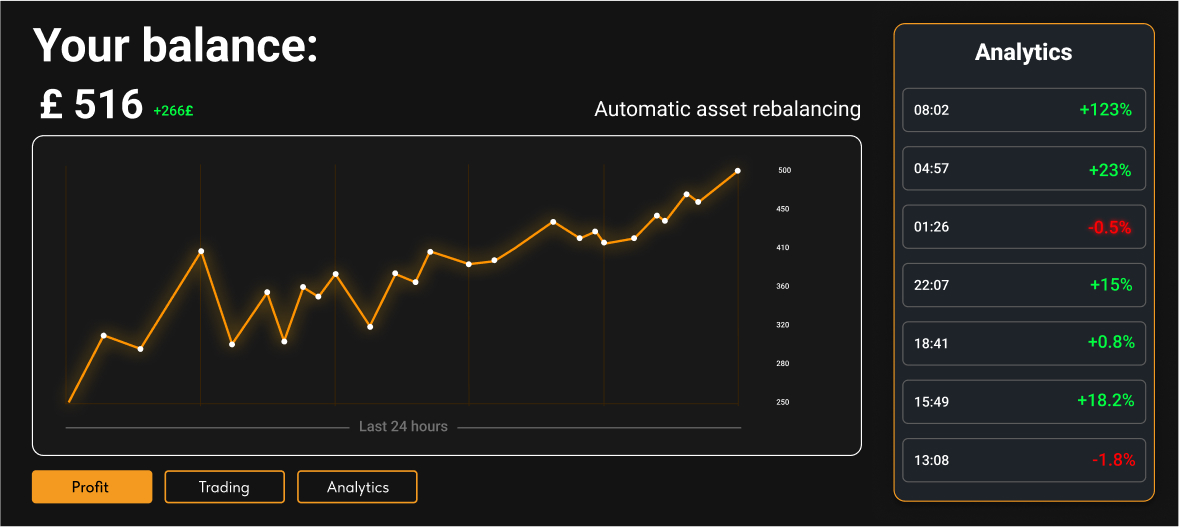

I opened the platform the next morning — the account showed £516. Almost a 2x return in just 24 hours. The algorithm had reallocated part of the portfolio into the tech sector (I spotted that in the analytics section).

I still hadn’t done a thing — the system was deciding when to buy and lock in profits entirely on its own. At this point, I was genuinely intrigued.

DAY 7

DAY 7

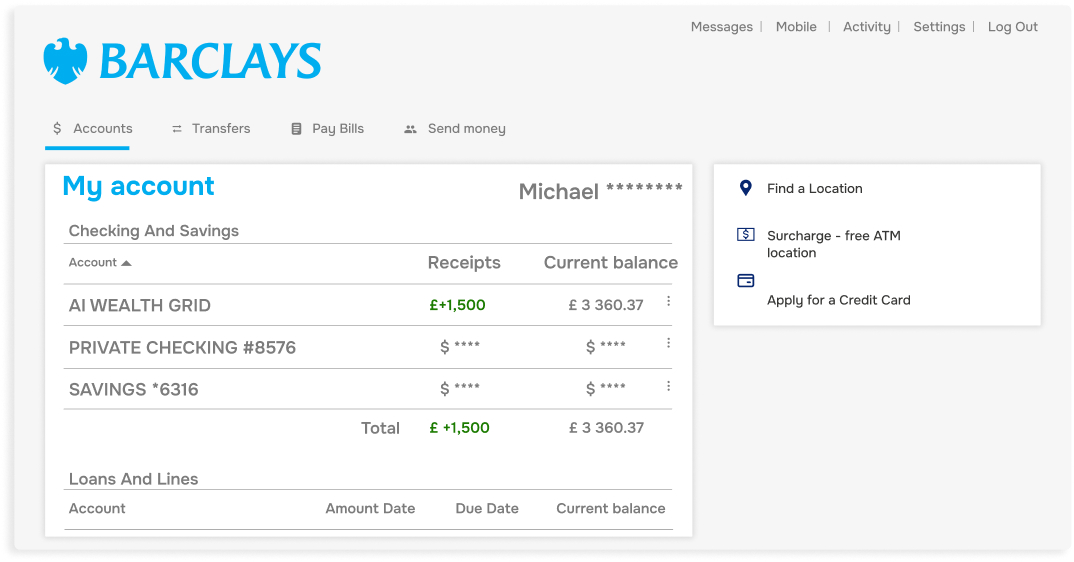

I decided to wrap up the test. Final balance — £2,783. Over the course of a week, the system executed 64 trades — 57 of them ended in profit. I withdrew £1,500 to my card (it arrived the same day) and left the rest in the system.

From a user perspective, it doesn’t feel like another “magic button”. It’s more like a reliable process running quietly in the background — I focus on my work, and the system quietly does its own. No noise, no flashy charts, no fuss.

QUICK START GUIDE: HOW TO BEGIN

- Follow the link provided by our editorial team to register.

- Wait for a call from a platform representative to verify your account.

- Fund your account — the minimum starting amount is £250.

- Once activated, the system will begin managing your investments automatically — no manual input required.

- Withdrawals can be made at any time. Processing typically takes between 2 and 24 hours, depending on your bank.

We will continue to follow the development of this technology and update this article as new information becomes available. For now, AI Wealth Grid remains one of the most talked-about developments of 2025 within the investment community.

The beach town that became a Bitcoin testbed

How hygienic are public swimming pools?

El Zonte, a quiet surf town on El Salvador's coast, draws travellers not just for its waves, but for a bold financial experiment playing out in real time.

Jurassic World Rebirth has 'few thrills'

Starring Scarlett Johansson and Jonathan Bailey, the latest in the dinosaur blockbuster series follows the template created by the original Jurassic Park-but it's no match for it.